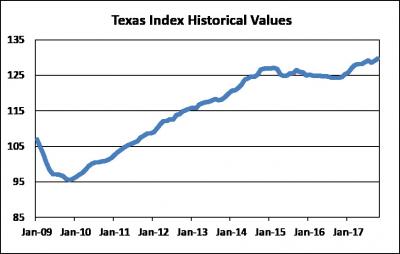

DALLAS, Jan. 3, 2018 /PRNewswire/ -- Comerica Bank's Texas Economic Activity Index grew 0.5 percent in October to a level of 129.7. October's index reading is 34 points, or 36 percent, above the index cyclical low of 95.5. The index averaged 124.7 points for all of 2016, one and one-fifth points below the average for 2015. September's index reading was revised to 129.0.

The Comerica Bank Texas Economic Activity Index improved again in October after returning to growth in September. The Texas Index has been improving steadily since November 2016, with only one monthly decline since then, occurring this past August. The overall pattern since late 2009 is consistent with the overall improvement in the U.S. economy since the Great Recession and with the up-and-down path of oil prices since then. The October 2017 index value was 4.4 percent higher than October 2016. Positive index components in October were nonfarm payrolls, housing starts, house prices, total state trade and hotel occupancy. Negatives were unemployment insurance claims (inverted), industrial electricity demand, the drilling rig count and state sales tax revenues. We expect to see more improvement in the Texas Index through the end of 2017 and into early 2018 with improvement in the state labor market and energy sector. Recent gains in crude oil prices will support drilling activity through year end, boosting economic growth for Texas. We also look for gains in the export of crude oil, refined petroleum products, natural gas and liquified natural gas through 2018 as the global economy gains momentum. Last year saw record natural gas consumption in the U.S. A stronger U.S. economy in 2018, plus a cold start to the new year, should keep that trend going.

The Texas Economic Activity Index consists of nine variables, as follows: nonfarm payroll employment, continuing claims for unemployment insurance, housing starts, house price index, industrial electricity sales, Texas rotary rig count, total trade, hotel occupancy and sales tax revenue. All data are seasonally adjusted. Nominal values have been converted to constant dollar values. Total index levels are expressed in terms of three-month moving averages.

Comerica Bank is a subsidiary of Comerica Incorporated (NYSE: CMA), the largest U.S. commercial bank headquartered in Texas, strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition to a local banking center network throughout Dallas-Fort Worth, Houston, Austin, San Antonio and Kerrville, Texas, Comerica Bank locations can be found in Arizona, California, Florida and Michigan, with select businesses operating in several other states, as well as in Canada and Mexico.

To subscribe to our publications or for questions, contact us at ComericaEcon@comerica.com. Archives are available at http://www.comerica.com/insights. Follow us on Twitter: @Comerica_Econ.

SOURCE Comerica Bank