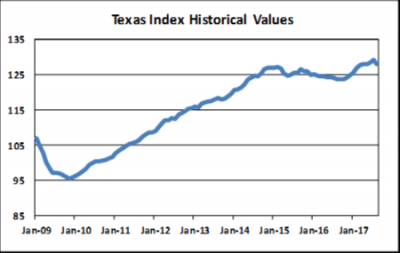

DALLAS, Oct. 31, 2017 /PRNewswire/ -- Comerica Bank's Texas Economic Activity Index decreased by 0.9 percent in August to a level of 127.9. August's index reading is 32 points, or 34 percent, above the index cyclical low of 95.5. The index averaged 124.3 points for all of 2016, one and three-fifths points below the average for full-year 2015. July's index reading was 129.1.

The Comerica Bank Texas Economic Activity Index dipped in August after increasing for the prior two months. The Texas economy has been buffeted by a dynamic energy market and Hurricane Harvey in recent months and has shown remarkable resilience to both sets of events. Houston is largely back to work after the record-breaking flooding of late August through early September. The industrial base is well on its way back to full operating capacity. The lingering effects of Hurricane Harvey will be borne by the households that endured extensive property damage due the flooding. According to Moody's Analytics, Harvey caused $73.5 billion in economic losses, second only to Hurricane Katina in 2005. Our index results for August were mixed. Three out of nine sub-indexes were positive for the month. They were nonfarm payrolls, house prices and industrial electricity demand. The four negative components were housing starts, the state rig count, total state trade and state sales tax revenues. Unemployment insurance claims were neutral for August. We expect to see more mixed results in September. We already know that state payroll employment fell by 7,300 jobs in September, so that will be a drag. Looking ahead, we expect to see positive economic momentum for the state to re-emerge before the end of the year. The rebuilding effort in South Texas will be a positive, as will recently firming oil prices.

The Texas Economic Activity Index consists of nine variables, as follows: nonfarm payroll employment, continuing claims for unemployment insurance, housing starts, house price index, industrial electricity sales, Texas rotary rig count, total trade, hotel occupancy and sales tax revenue. All data are seasonally adjusted. Nominal values have been converted to constant dollar values. Total index levels are expressed in terms of three-month moving averages.

Comerica Bank is a subsidiary of Comerica Incorporated (NYSE: CMA), the largest U.S. commercial bank headquartered in Texas, strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition to a local banking center network throughout Dallas-Fort Worth, Houston, Austin, San Antonio and Kerrville, Texas, Comerica Bank locations can be found in Arizona, California, Florida and Michigan, with select businesses operating in several other states, as well as in Canada and Mexico.

To subscribe to our publications or for questions, contact us at ComericaEcon@comerica.com. Archives are available at http://www.comerica.com/insights. Follow us on Twitter: @Comerica_Econ.

SOURCE Comerica Bank